Given that food expenses account for such a large portion of a restaurant’s budget – typically ranging from 20% to 40% – choosing the right inventory costing method can make a significant difference to a restaurant’s bottom line. The choice has large implications on various aspects of a restaurant’s operations, from tax payments to profitability.

Put simply, effective inventory costing and management is one of the key factors that determine the financial success of a restaurant.

With inventory costing options like FIFO, LIFO, and WAC, restaurateurs need to figure out which method fits their business best. This article provides restaurant owners with a clear understanding of how these inventory costing methods function and their potential effects on the business’ bottom line.

What Is Inventory Costing?

Inventory costing is an accounting method used by restaurants to determine the value of their inventory at the end of a given period. This process is used for calculating a restaurant’s gross profit.

Inventory costing impacts financial statements, informs pricing strategies, influences budgeting decisions, and plays a crucial role in managing food costs effectively. Importantly, it has a direct impact on how you manage and use your restaurant’s ingredients.

A good inventory management software solution can help with all of this complexity.

What’s the Difference Between Inventory and COGS?

While these two terms are related and may seem similar, they’re actually quite different.

Inventory refers to the cost of items a restaurant currently has in stock, while COGS refers to the cost of items a restaurant has already sold.

What Is Inventory?

Inventory refers to the goods and materials that a restaurant holds at any given time. This includes raw ingredients, prepped items, and non-food supplies.

The ultimate goal is to sell these items. But while they’re held by the restaurant, they count as inventory.

From an accounting standpoint, inventory counts towards an asset on the business’s balance sheet.

What is COGS (the Cost of Goods Sold)?

After inventory is made into recipes and sold to customers, the cost of the items used for these recipes represents the Cost of Goods Sold (COGS).

In other words, the Cost of Goods Sold (COGS) is the direct cost attributable to the production of the goods sold by the restaurant.

COGS mainly includes the cost of ingredients used to make recipes and the associated labor costs of making them. It doesn’t include indirect expenses, such as distribution costs or marketing costs.

From a balance sheet perspective, COGS counts as an expense. It’s deducted from revenue to determine the gross profit of the restaurant.

The Difference

The primary difference between inventory and COGS lies in their stage within the business cycle.

Inventory is considered an asset and is listed as such on the balance sheet because it represents future economic benefits to the company through sales or production use. On the other hand, COGS is an expense recorded on the income statement, reflecting the cost associated with the goods that have been sold during a period.

Essentially, inventory becomes COGS once the product is sold, moving from an asset on the balance sheet to an expense that impacts the income statement, which in turn influences a restaurant’s profitability.

Get the ultimate guide to inventory management software

- Inventory management software essentials

- What does inventory management software do?

- Signs you need this software

- How much money I can save & ROI

Inventory Costing Methods

FIFO (First In, First Out)

What is FIFO?

FIFO is a method where the oldest stock (first in) is used before newer stock (first out). This approach is particularly beneficial for managing perishable goods in restaurants to minimize waste.

The FIFO (First In, First Out) method is the most widely adopted inventory costing method by the restaurant industry.

It naturally fits into a restaurant’s operations, since restaurants want to use ingredients that are closer to expiration before the ones that will last longer.

How restaurants use the FIFO inventory method

FIFO is originally an accounting term, but it also has a direct impact on how a restaurant manages its inventory.

Choosing FIFO as your inventory costing method will drive how your restaurant chooses stock to use and sell. It assumes that a restaurant uses its oldest ingredients first.

When preparing recipes, chefs and kitchen staff prioritize using the oldest ingredients first, and keep the newer ones in storage.

This method fits naturally with a restaurant’s operations since restaurants typically want to use ingredients that are closer to expiration so that spoilage can be reduced.

How to calculate COGS using FIFO

To calculate COGS using the FIFO method, you’ll calculate the costs of all the items sold within a given period. You’ll need to know the price you paid for your inventory and the number of sales to customers.

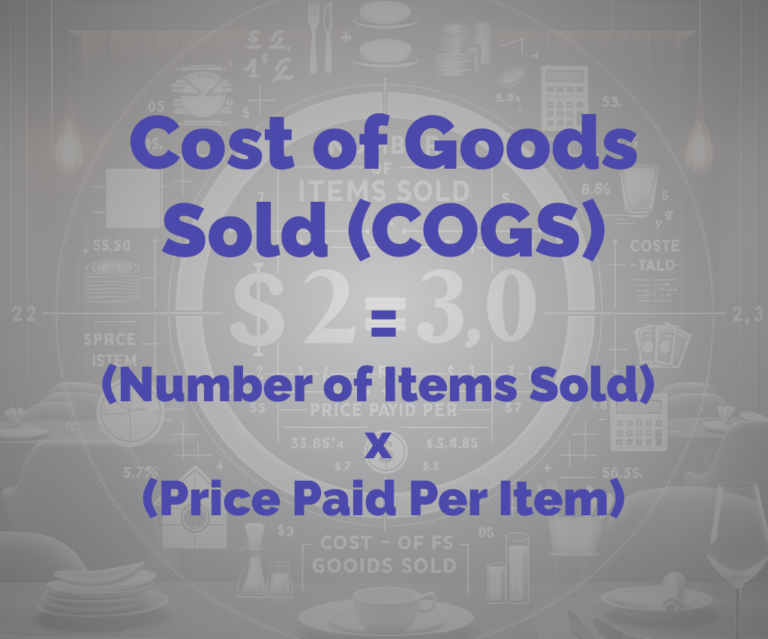

The Cost of Goods Sold (COGS) formula is:

(Number of Items Sold) * (Price Paid Per Item) = Cost of Goods Sold

We’ll start with an example using a period of one month:

- Let’s say you start the month with 20 steaks on hand, and you purchased those steaks for $10 each.

- Later in that month, you purchased an additional 50 steaks at $12 each.

- And during that month, you sold a total of 35 steaks to customers.

In your COGS calculation, you’ll use the price of the oldest inventory first. After you run out of the oldest inventory, you’ll move on to using the price of the newer one.

Remembering that you sold 35 steaks during the month, you’ll use the following costs:

- First use the old inventory: 20 steaks * $10 each = $200

- Next use the new inventory: 15 steaks * $12 each = $180

In this example, COGS = (20 steaks * $10 each) + (15 steaks * $12 each) = $380.

Pros of FIFO

- Easy to start. FIFO is easy to implement since it matches with how kitchen staff naturally uses older ingredients first.

- Minimizes spoilage. By using ingredients that are closest to expiration first, spoilage is reduced.

- Controls costs. Since the oldest ingredients are used first, restaurants can avoid purchasing too much unnecessary stock.

- Increases net income during inflationary periods. During periods where costs are rising, FIFO ensures that older, cheaper stock is used first. This keeps the newer, more expensive stock as inventory, which creates a higher net income on balance sheets.

Cons of FIFO

- Organizing and tracking inventory in the order that they’re received can be cumbersome.

- During inflationary periods, FIFO can cause higher income taxation because the restaurant is showing a higher net income.

- Costs and revenues can mismatch since older, cheaper items are calculated with current revenue.

Within the context of the restaurant industry, the benefits of FIFO generally outweigh the drawbacks. Because of this, most restaurants choose FIFO as their costing method.

LIFO (LAST In, First Out)

What is LIFO?

LIFO is in essence the opposite of FIFO.

With this method, the newest stock is used first. This means that the oldest stock would be maintained as inventory.

Since most restaurants are looking to use stock before it expires, LIFO is less commonly used in the restaurant industry.

Should restaurants use the LIFO inventory method?

Generally, restaurants should avoid using the LIFO method.

Since the LIFO method emphasizes using the newest stock first, this method lets your oldest inventory perpetually sit in stock.

Needless to say, this leads to spoilage of perishable goods held in the inventory.

Also of note is that from an accounting perspective, LIFO is only permissible in the United States.

How to calculate LIFO

To calculate COGS using the LIFO method, you’ll calculate the cost of items sold using their latest prices.

We’ll go back to the earlier example, where the restaurant had the following inventory costs:

- Starting inventory of 20 steaks purchased at $10 each.

- Purchased an additional 50 steaks during the month at $12 each.

- Sold 35 steaks to customers during the month.

The Cost of Goods Sold (COGS) formula is:

(Number of Items Sold) * (Price Paid Per Item) = Cost of Goods Sold

In this example, we use the latest cost per steak, and COGS = (35 steaks * $12 each) = $420.

Pros of LIFO

- Costs and current revenues more closely match.

- May result in reduced income tax liabilities. In certain jurisdictions, LIFO can reduce taxable income by matching higher recent costs against current revenues.

- It’s easier for staff to stack and store new goods received. Newer goods can be placed in front of the older goods on shelves, improving efficiency.

Cons of LIFO

- Higher COGS, resulting in a lower net profit.

- Does not make sense for perishable inventory, since leaving the older stock unused leads to spoilage.

- From an accounting perspective, LIFO use isn’t permitted outside of the United States.

WAC (Weighted Average Costing)

What is WAC?

The weighted average costing method falls between FIFO and LIFO.

It simply uses the average cost of your items, regardless of when they were purchased. With this method, all of your inventory items will have the same valuation, regardless of their fluctuations in purchase price.

How restaurants use the WAC inventory method

WAC is useful for restaurants in certain cases. For example, WAC may useful for restaurants who want to simplify their bookkeeping or who have inventory that doesn’t fluctuate greatly in price.

At the end of a period, a restaurant will take the total cost of all inventory items remaining in stock, and divide that by the number of inventory items.

How to calculate WAC

To calculate WAC, you’ll simply take the valuation of your inventory and divide it by the total number of items.

The WAC formula is:

WAC = (Total Cost of Goods Available) / (Number of Units of Goods)

For example:

- In January, a restaurant purchased 50 cans of tomatoes at $5 each.

- In February, they purchased 40 cans of tomatoes at $6 each.

The total cost of goods available = (50 * $5) + (40 * $6) = $490

If the number of units of goods is 100 cans of tomatoes, then WAC = $490 / 100, or $4.90 per can of tomatoes.

Pros of WAC

- Faster and easier to calculate than FIFO or LIFO.

- Easier to track if you don’t have accounting software or you don’t want to hire an accountant.

- Inventory prices will be more stable over time.

Cons of WAC

- Does not work well for ingredients that have a significant variation in cost.

- Does not work well for ingredients that spoil, as your financial records won’t match your actual operational practices.

- Presumes that all goods are identical.

The Bottom Line

For the majority of restaurants, FIFO is the method that makes the most sense for their businesses.

It naturally matches with how restaurants want to use ingredients before they spoil. And it helps to reduce costs since you can avoid purchasing unnecessary stock.

In some cases, WAC might be a suitable alternative. WAC might be most appropriate for businesses who are new to inventory costing and want to keep processes simple. It can also work for certain restaurant types that don’t have highly fluctuating inventory prices. Most restaurants won’t fit this case.